-

Corporate Governance Report

(493KB)

Corporate Governance Report

(493KB)

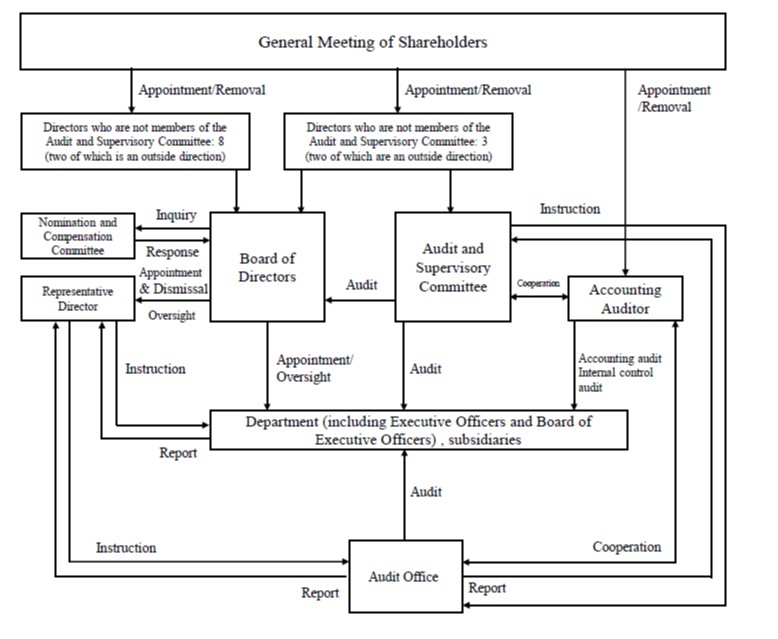

For its corporate governance system, NIHON CHOUZAI has opted to be a company with an Audit and Supervisory Committee. The Company has established a general meeting of shareholders, Board of Directors, and Audit and Supervisory Committee as stipulated by the Companies Act.

The Articles of Incorporation stipulate that the Company shall have no more than 15 directors (excluding members of the Audit and Supervisory Committee) and no more than three directors on the Audit and Supervisory Committee, and that there shall be a distinction between Audit and Supervisory Committee members and other directors, who shall be appointed at the general meeting of shareholders. The Articles of Incorporation further stipulate that a director shall be elected by receiving the majority of votes cast by shareholders at a general meeting of shareholders, where at least one-third of shareholders with voting rights are present.

(Board of Directors)

NIHON CHOUZAI's Board of Directors comprises 11 directors, of whom four are outside directors. The Board of Directors generally convenes once a month to supervise business operations and to make decisions on such topics as important matters concerning business management and items stipulated by laws, regulations, and the Articles of Incorporation. President and CEO Kazunori Ogi serves as the Chairperson of the Board of Directors. The other members are Chairman and Representative Director Hiroshi Mitsuhara, Director Naoto Kasai, Director Toshiyuki Koyanagi, Director Yoshihisa Fujimoto, Director Masahiro Inoue, Outside Director Yoshimitsu Onji, Outside Director Mikiharu Noma, Director Nobuyuki Hatakeyama, Outside Director Shio Harada , and Outside Director Tomomi Nakano.

(Audit and Supervisory Committee)

NIHON CHOUZAI's Audit and Supervisory Committee comprises three directors who are members of the Audit and Supervisory Committee (one full-time director and two outside directors). The committee generally convenes once a month to deliberate and endeavor to enhance supervisory functions concerning the execution of duties by directors.

Nobuyuki Hatakeyama serves as the Chairperson. Other members are Outside Director Shio Harada and Outside Director Tomomi Nakano.

(Nomination and Compensation Committee)

The Nomination and Compensation Committee comprises three or more members who are directors, the majority of whom are independent outside directors. The Nomination and Compensation Committee deliberates upon and responds to inquiries from the Board of Directors on such matters as nominations and remuneration of directors.

The composition of the Nomination and Compensation Committee is as follows.

The Chairperson is Chairman and Representative Director Hiroshi Mitsuhara. The other members are President and CEO Kazunori Ogi, Outside Director Yoshimitsu Onji, Outside Director Mikiharu Noma, Outside Director Shio Harada, and Outside Director Tomomi Harada.

Given the scale of our Company and its business activities, we decided that being a company with an Audit and Supervisory Committee matches our basic thinking on corporate governance and that this enhances our auditing and supervisory functions and corporate governance. Therefore, we decided in 2016 to adopt a system as a company with an Audit and Supervisory Committee.

The Company engages in dialogue with shareholders, led by the President & CEO and the Group Corporate Planning Department, in collaboration with directors and departments involved in SR and IR activities.

The Company holds biannual earnings briefings as opportunities for dialogue with institutional investors and shareholders. The President & CEO and the General Manager of the Group Corporate Planning Department lead the presentations, with relevant directors sometimes joining the Q&A sessions.

Led by the global IR team within the Group Corporate Planning Department, the Company actively conducts IR meetings, phone interviews, and small meetings with domestic and international investors. The Company regularly provides feedback to management and the Board of Directors on shareholder and investor opinions and concerns. Recently, the Company has focused on investor dialogue to achieve "management that is conscious of capital costs and stock prices," with feedback from these discussions shared with management.

During the period before earnings announcements, the Company designates a quiet period to limit dialogue with shareholders and investors while ensuring strict internal information management.